All Categories

Featured

Table of Contents

Getting rid of agent settlement on indexed annuities enables for dramatically greater illustrated and actual cap prices (though still markedly lower than the cap rates for IUL policies), and no doubt a no-commission IUL policy would push detailed and actual cap rates higher. As an aside, it is still possible to have an agreement that is very abundant in agent payment have high very early money surrender worths.

I will acknowledge that it goes to least theoretically feasible that there is an IUL plan available released 15 or twenty years ago that has provided returns that are remarkable to WL or UL returns (a lot more on this listed below), however it is very important to better understand what a proper comparison would involve.

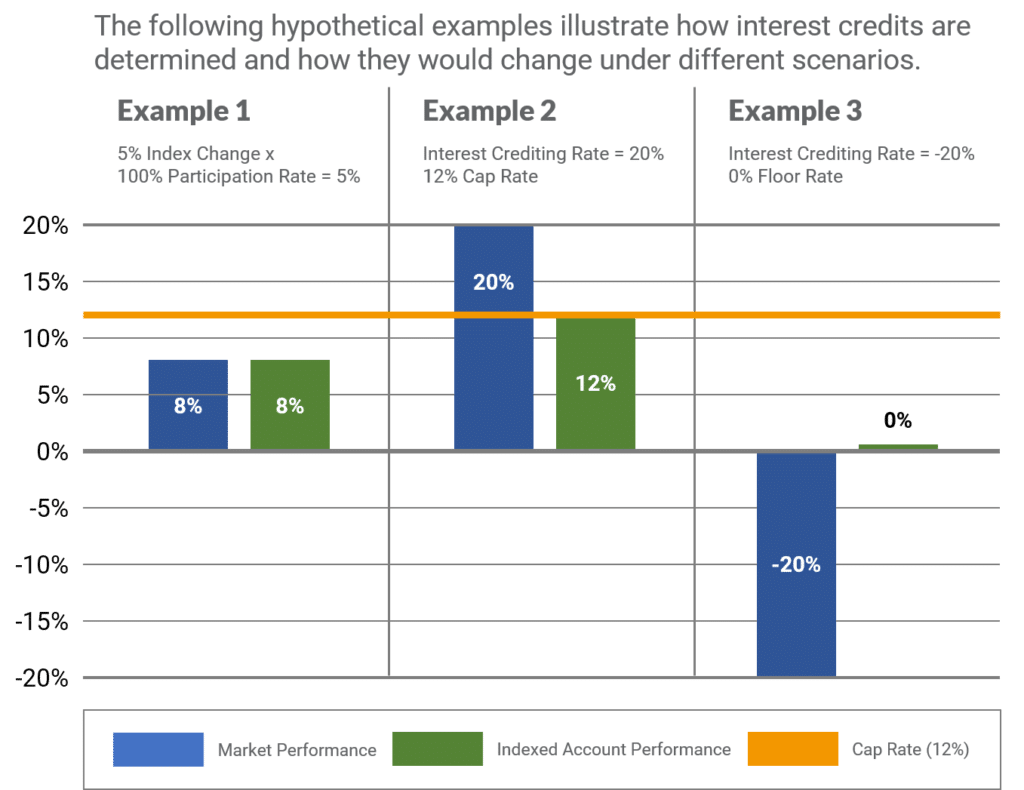

These policies usually have one bar that can be evaluated the firm's discretion each year either there is a cap price that specifies the maximum crediting rate in that particular year or there is an engagement price that defines what percentage of any type of favorable gain in the index will be passed along to the policy in that specific year.

And while I normally concur with that characterization based upon the technicians of the plan, where I take concern with IUL supporters is when they define IUL as having exceptional go back to WL - iul agent near me. Lots of IUL supporters take it an action better and indicate "historic" information that appears to sustain their claims

There are IUL plans in presence that carry even more threat, and based on risk/reward principles, those policies should have greater anticipated and actual returns. (Whether they actually do is an issue for major argument but business are using this strategy to help validate higher detailed returns.) Some IUL policies "double down" on the hedging method and assess an added charge on the policy each year; this charge is then utilized to increase the options budget; and then in a year when there is a favorable market return, the returns are intensified.

Nationwide Iul

Consider this: It is possible (and as a matter of fact likely) for an IUL plan that averages a credited price of say 6% over its first 10 years to still have a general negative price of return throughout that time as a result of high costs. Numerous times, I find that representatives or consumers that boast regarding the performance of their IUL policies are perplexing the attributed price of return with a return that correctly shows all of the policy charges as well.

Next we have Manny's concern. He claims, "My buddy has been pushing me to acquire index life insurance coverage and to join her service. It looks like an Online marketing.

Insurance sales people are not bad individuals. I made use of to sell insurance coverage at the start of my job. When they offer a premium, it's not uncommon for the insurance coverage firm to pay them 50%, 80%, also sometimes as high as 100% of your first-year premium.

It's hard to offer since you got ta always be seeking the next sale and going to discover the following person. And especially if you do not really feel extremely convicted about the important things that you're doing. Hey, this is why this is the very best solution for you. It's going to be tough to locate a great deal of gratification because.

Allow's speak about equity index annuities. These things are prominent whenever the marketplaces are in a volatile duration. Yet below's the catch on these things. There's, first, they can control your actions. You'll have surrender periods, generally seven, 10 years, perhaps even past that. If you can not obtain accessibility to your money, I understand they'll inform you you can take a little percent.

Difference Between Whole Life And Iul

Their surrender periods are big. That's how they know they can take your money and go fully spent, and it will be okay because you can't get back to your money up until, once you're into 7, ten years in the future. That's a long-term. Regardless of what volatility is going on, they're probably mosting likely to be fine from an efficiency viewpoint.

There is no one-size-fits-all when it comes to life insurance policy./ wp-end-tag > In your hectic life, financial independence can seem like an impossible objective.

Fewer employers are supplying traditional pension plan strategies and many companies have decreased or terminated their retired life plans and your ability to depend entirely on social safety and security is in inquiry. Even if advantages have not been lowered by the time you retire, social security alone was never ever intended to be enough to pay for the way of life you want and should have.

Whole Life Vs Universal Life Chart

/ wp-end-tag > As part of a sound financial strategy, an indexed global life insurance coverage policy can assist

you take on whatever the future brings. Prior to devoting to indexed global life insurance policy, right here are some pros and cons to take into consideration. If you pick a great indexed universal life insurance plan, you might see your cash money worth expand in worth.

Given that indexed global life insurance coverage calls for a specific level of threat, insurance coverage business tend to keep 6. This type of strategy additionally offers.

Finally, if the chosen index doesn't execute well, your money worth's development will be influenced. Normally, the insurance provider has a beneficial interest in carrying out much better than the index11. There is normally a guaranteed minimum passion rate, so your plan's development will not fall below a specific percentage12. These are all variables to be thought about when picking the most effective kind of life insurance policy for you.

Given that this type of plan is extra complex and has a financial investment element, it can frequently come with greater costs than other plans like entire life or term life insurance policy. If you don't assume indexed global life insurance policy is best for you, here are some options to take into consideration: Term life insurance policy is a short-lived policy that generally supplies protection for 10 to 30 years.

Selling Universal Life Insurance

Indexed universal life insurance policy is a type of policy that supplies much more control and flexibility, in addition to greater cash money worth development possibility. While we do not supply indexed universal life insurance policy, we can provide you with more details concerning entire and term life insurance policy policies. We advise checking out all your choices and talking with an Aflac representative to find the very best fit for you and your family members.

The rest is contributed to the cash money value of the plan after costs are subtracted. The cash value is credited on a month-to-month or yearly basis with rate of interest based upon increases in an equity index. While IUL insurance policy may prove useful to some, it is essential to comprehend just how it functions prior to purchasing a plan.

Table of Contents

Latest Posts

Cost Insurance Life Universal

指数 型 保险

Universal Insurance Usa

More

Latest Posts

Cost Insurance Life Universal

指数 型 保险

Universal Insurance Usa